Home » » Equipment Breakdown Insurance

| Need a equipment breakdown insurance quote? Call us toll free at 1-866-287-0448 &/or visit our Get A Quote page. |

Think about the impact on your business if your equipment fails. Immediately, your operations are interrupted. How will you deliver your orders? If you don’t have backup equipment, you may need to find alternate facilities or rent equipment, which will increase your costs. What if customers can’t wait? Orders may be cancelled, which means you will suffer loss of revenue, and possible damage to your reputation. Personal injury could also result.

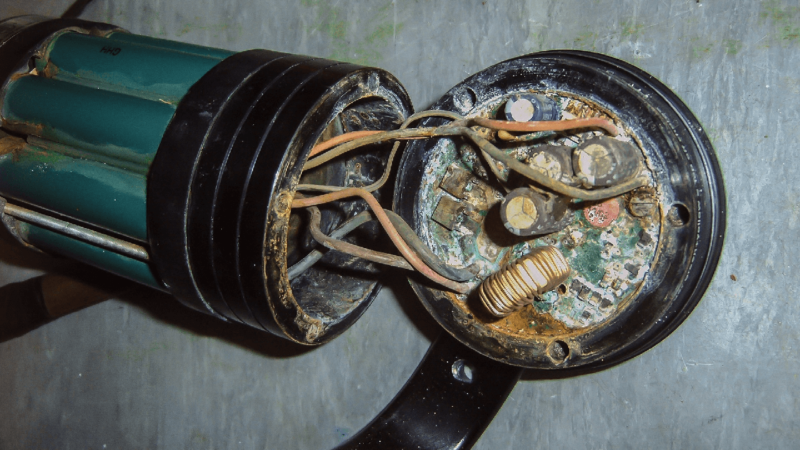

Equipment Breakdown Coverage is insurance against your business’ key equipment malfunctioning or breaking down, either due to accidental or sudden damage. If your equipment fails, you can’t do business and having your operations interrupted means you can’t fulfill your obligations to your clients and customers. Typical Commercial Property Insurance policies only cover losses external forces, such as extreme weather and theft. If your equipment malfunctions due to events like electrical arcing, mechanical breakdown or power surges, equipment breakdown coverage applies.

Unless you can come up with a backup plan, your customers might decide to cancel their orders and not order from you in the future. Having Equipment Breakdown Coverage means you will be covered for the cost of repair and replacement and also in the event you have to rent equipment to run your business or rent another facility.

Equipment breakdown insurance covers the sudden and accidental, physical damage to equipment that requires its repair or replacement. It applies to equipment in the following categories:

A typical commercial property policy does not cover loss or damage caused by:

Any business that relies on equipment to run a business, whether it be computers or mechanical or electrical equipment, should have equipment breakdown insurance in place. Equipment breakdown insurance will cover you for replacement or repair if the equipment is physically damaged suddenly or accidentally. You may also choose to add equipment rental to keep your business running to your policy if you can’t be without it.

The more expensive the equipment you have, the more you need this type of coverage rather than be faced with replacing or repairing the equipment yourself.

The cost of equipment breakdown insurance will depend on your business. The amount of equipment you own, the size and scope of your business, the number of employees you have -– these are all factors that will help determine the policy you need. Your ALIGNED agent will also consider the following:

-Your business’ insurance claim history

-Your annual revenue

-The type and cost of the equipment you use

-The services you provide

The amount of coverage you require for equipment breakdown will depend on the characteristics of your specific business and will be tailored to it. You need to be covered to repair or replace any of your business equipment that is in need of repair or replacement due to sudden or accidental damage.

To learn more about ALIGNED, our commitment to providing insurance expertise and the best insurance products or solutions, talk to one of our advocates today. We can help you secure the best products, services and solutions for your business.

What is Boiler and Machinery Insurance?

Machinery Parts Manufacturer Insurance

| ALIGNED Across Canada 100% Canadian owned, ALIGNED is a premiere insurance brokerage that serves more than 1,400 clients across the country. ALIGNED’s offices in Toronto, Calgary and Vancouver are supported by a national operations centre in Cambridge, Ontario. Uniquely within the industry, ALIGNED creates, negotiates and delivers the best business insurance and risk management strategies/solutions to organizations like yours. |

Sources: https://www.munichre.com/HSBBII/en